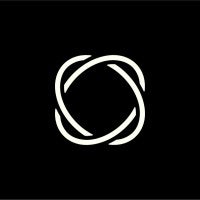

Buy + Sell Private Company Shares. Trading, Settlement, Market Data.

Technology That Fuels The Private Market

Estimated last round valuation is derived from any combination of publicly available sources such as company, state, or federal filings and press releases.

Secondary Solutions for Companies + People to Transact with Confidence

Private Companies ↓

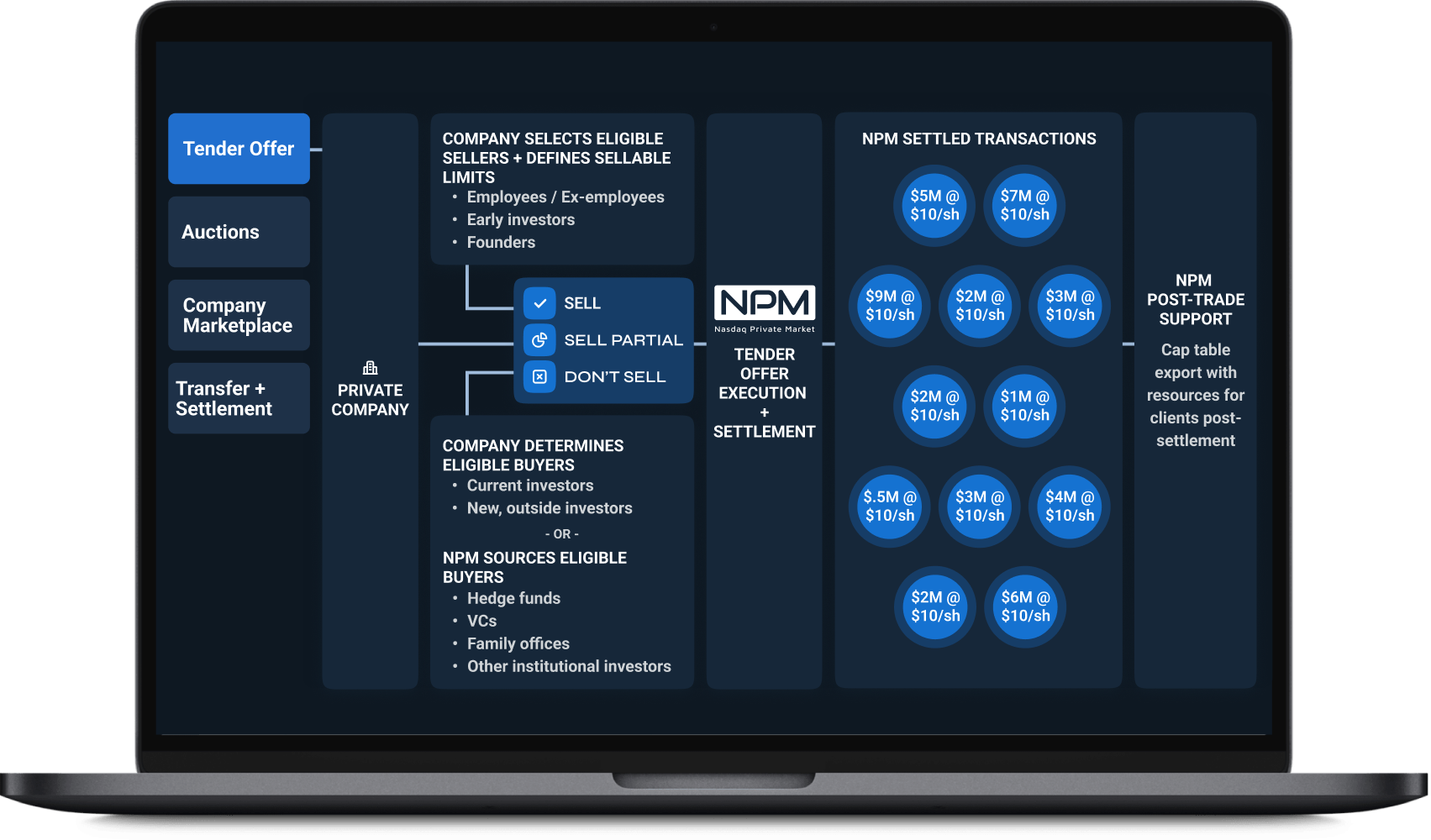

01Liquidity Opportunities Across Each Stage of Growth: Multiple Products. One Partner.

The liquidity needs of private companies are continually evolving. We help you expertly navigate secondary activity at each stage of your company lifecycle.

Learn More east

Employees + Shareholders ↓

02Sell Your Shares Through A Global Marketplace

Access accredited institutional investors and brokers with deep pools of capital. Sell your holdings via our trading platform SecondMarketTM and support from our experienced product specialists.

Learn More eastInvestors ↓

03Join An Institutional Marketplace. Intelligently Invest in Unicorns + Disruptive Companies.

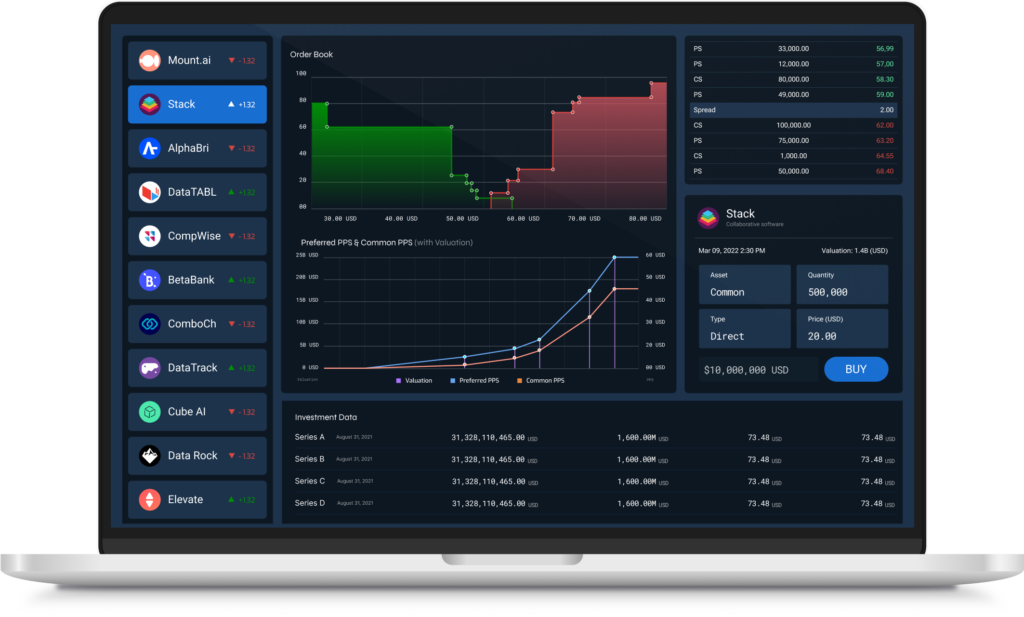

Capitalize on untapped opportunities. Invest efficiently and confidently through SecondMarket™, our advanced trading platform.

Learn More eastBanks + Brokers ↓

04Private Market Trading Technology

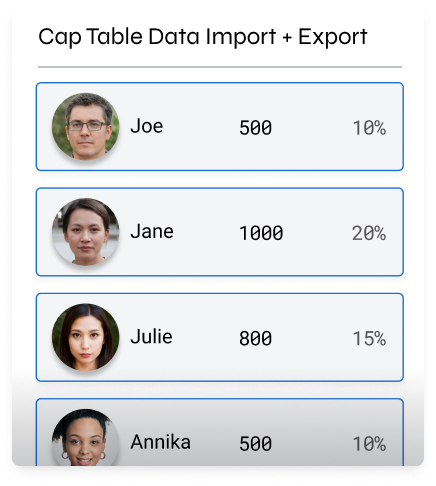

Enterprise software and an institutional marketplace SecondMarket™ for banks, brokers, investors, and shareholders to connect. Turnkey services to scale your private market franchise.

Learn More eastLaw Firms ↓

05Liquidity Platform Chosen by Law Firms and Legal Counsels

Act as a trusted advisor to clients by partnering with an experienced deal team to structure and facilitate secondary transactions.

Learn More east

Expertly Navigating the Private Market with Disruptive Technology + Dedicated Product Specialists

Get Started eastDecade of Experience

- Ten years of delivering shareholder, employee, investor, and leadership team solutions

- Precisely trading private company stock pre-IPO and uncovering actionable market data

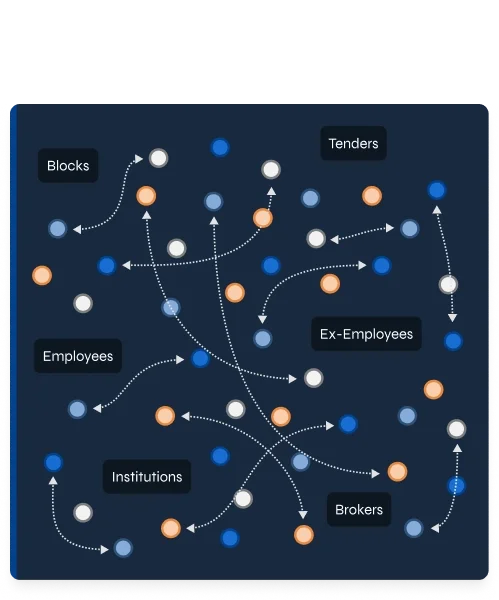

Premier Global Network

- Network of private companies, employees, shareholders, investors, banks, and brokers

- Clients driven to trusted trading platform for ability to connect credible buyers and sellers

Tech-Forward

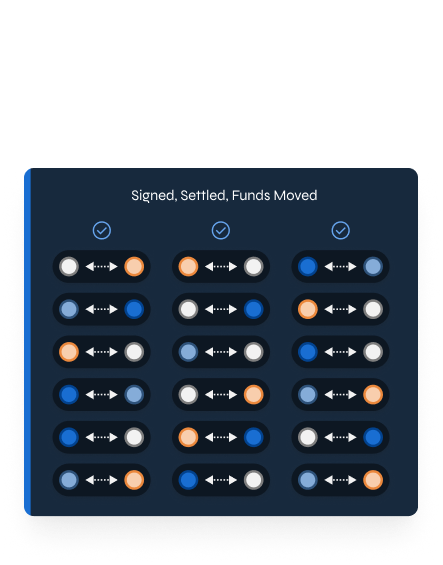

- Proprietary, next-generation private market technology, software, infrastructure, and connectivity

- Trading marketplace, company liquidity programs, and settlement powered by advanced trading tools

Data-Driven

- High information platform sourcing trade data, valuations, and market intelligence

- Market structure commentary, industry trend analysis, benchmarks, and financial products

Unlock the Private Market Today

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of January 2024

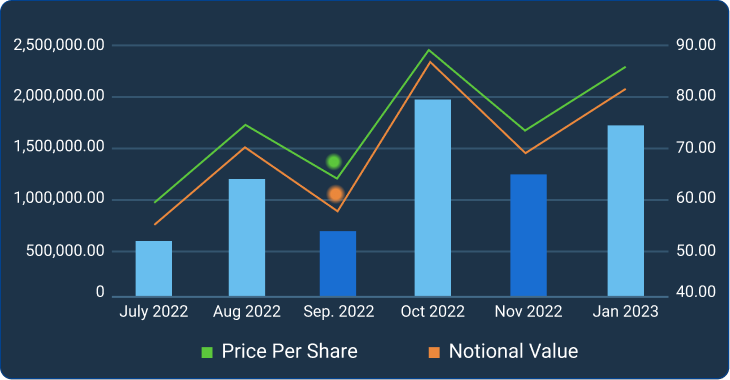

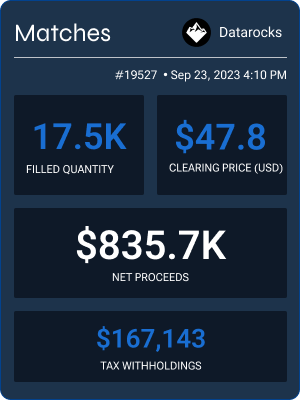

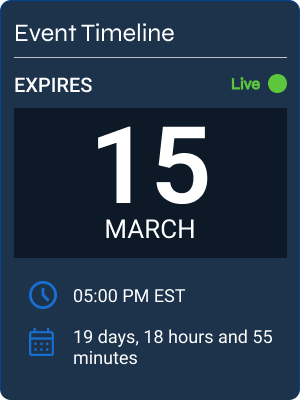

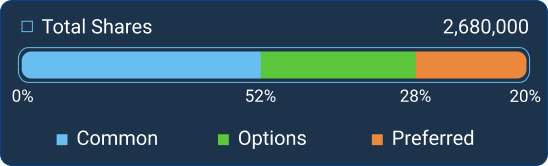

Access Institutional-Grade Metrics + Analytics

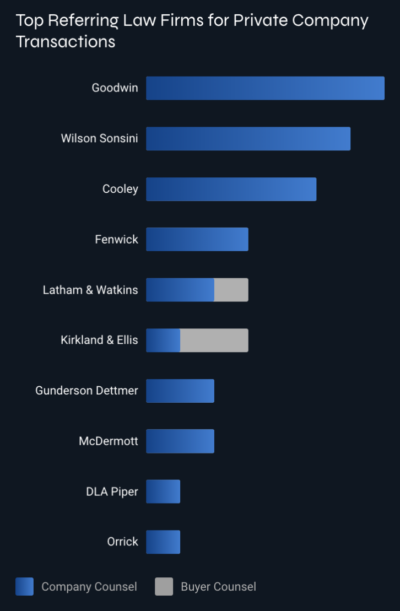

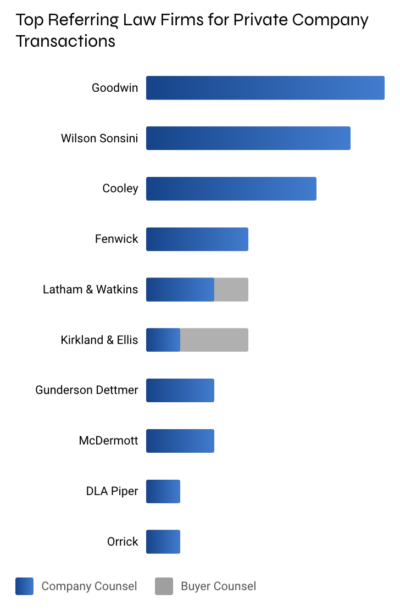

Top Referring Law Firms for Private Company Transactions

-

Goodwin

-

Wilson Sonsini

-

Cooley

-

Fenwick

-

Latham & Watkins

-

Kirkland & Ellis

-

Gunderson Dettmer

-

McDermott

-

DLA Piper

-

Orrick

- Company Counsel

- Buyer Counsel

Client Industry Breakdown

Banking, Payments, Investments + Insurance

22%

Banking, Payments, Investments + Insurance

22%

Information Technology

19%

Information Technology

19%

Entertainment Products + Services

14%

Entertainment Products + Services

14%

Business Support Services

11%

Business Support Services

11%

Household Goods + Services

11%

Household Goods + Services

11%

Biotech, Pharma + Health Care

8%

Biotech, Pharma + Health Care

8%

Energy

6%

Energy

6%

Food + Beverages

3%

Food + Beverages

3%

Media

3%

Media

3%

Real Estate

3%

Real Estate

3%

Our Recent Client Valuations

- 14% $0-$250M

- 6% $500M-$1B

- 17% $1B-$2B

- 40% $2B-$5B

- 23% $5B+

Global Client + Investment Network

- 🇦🇺 Australia

- 🇧🇲 Bermuda

- 🇧🇷 Brazil

- 🇨🇦 Canada

- 🇰🇾 Cayman Islands

- 🇨🇴 Colombia

- 🇪🇪 Estonia

- 🇫🇮 Finland

- 🇩🇪 Germany

- 🇭🇰 Hong Kong

- 🇮🇩 Indonesia

- 🇮🇱 Israel

- 🇯🇵 Japan

- 🇱🇺 Luxembourg

- 🇲🇽 Mexico

- 🇸🇬 Singapore

- 🇨🇭 Switzerland

- 🇸🇪 Sweden

- 🇺🇦 Ukraine

- 🇬🇧 United Kingdom

- 🇺🇸 United States

Data as of 2023