In recent weeks, a flurry of announcements from various platforms have promised to unlock the doors of the world’s top private companies to investments from retail investors. With many of the most innovative and fastest-growing companies staying private longer, these new offerings are often wrapped in the noble-sounding mission of “democratizing access to the private markets.” Their sales pitch is compelling:

“Why should only the big venture capital firms get a shot to invest in the next unicorn, while individual investors are left out? Isn’t expanding market access a good thing?”

Maybe.

It’s true that private markets offer access to some of the most dynamic, innovative companies in the world, and investing in pre-IPO companies can offer the potential for extraordinary returns. It is also true that broader investor access is, in principle, a positive development.

But the story is more complicated than that.

Today’s private investment landscape is complex, opaque, and often populated by opportunistic actors eager to capitalize on individual investors who mistakenly assume that the same investor protections afforded in the public markets apply here.

Spoiler alert: they don’t.

If you’re considering an investment in a private company, you need to bring a healthy dose of skepticism—and a long list of questions. That’s because many of the products in today’s private market that are marketed to individual investors are designed to indirectly invest in private companies that explicitly don’t want you as an investor.

Let me explain.

Imagine a real estate broker called and asked you to list your house for sale, and you declined. A few days later, you learn that the same real estate broker is now offering tokenized, fractionalized shares in your house without your permission. Justifiably, you would be furious. Why should a third party with no rights to your private asset make money by selling interests in it? This analogy is not far from what some platforms appear to be offering by tokenizing restricted private shares.

In this guide, I’ll outline the basic products, essential principles, and obvious red flags that everyone considering private market investing should understand, so you can better separate genuine opportunities from well-disguised traps.

Let’s start with some basics about how private markets actually work.

Private Markets 101

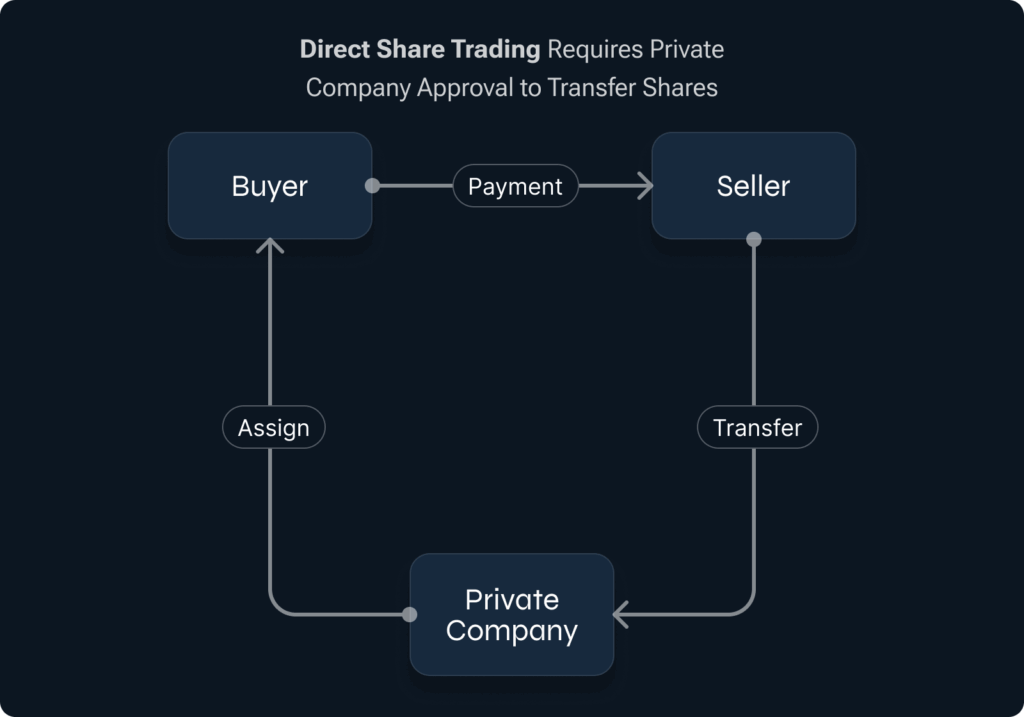

Unlike public stocks, the vast majority of private companies strictly control who can buy and sell their shares. Most private companies don’t want their stock trading freely on an open exchange. If they did, they would go public via an IPO. Instead, they maintain tight restrictions on ownership, trading, and transfer terms—typically laid out in their company bylaws and investor agreements. People new to the private markets are often surprised to learn that every single trade in a private share typically must be approved by the company before it can be finalized.

This is a fundamental distinction between public and private markets. In the public markets, trading is bilateral—as long as a buyer and seller agree on price and size, the transaction clears. In the private markets, trading is trilateral—the buyer, the seller, and the company all must agree to the terms in order for the trade to be completed. This fundamental difference makes private markets inherently less liquid and orders of magnitude more complex.

It is highly unlikely that, as an individual investor, you’ll be approved to buy shares directly in the most sought-after private companies. Even if you find a willing seller in the latest blockbuster unicorn, the company will almost certainly block the trade. Why? Because SEC rules limit private companies to having no more than 2,000 shareholders, so they don’t want retail investors crowding their cap table (the internal register of approved shareholders).

At this point, you might be thinking: “Wait a minute. Every time I open LinkedIn, I see a new platform offering me shares in hot private startups. I’ve also read that new tokenized private shares are making these investments more accessible to investors like me. What do you mean I can’t buy them?”

That confusion is exactly the problem. What seems like democratization on the surface is often more marketing than reality—and sometimes, worse.

Given the choice, direct share ownership is typically the best option for all investors large and small, as it keeps the investor aligned with the private company.

Notably, some private companies are perfectly happy to allow individual investors to purchase their shares directly. For an investor, this is the best-case scenario. Investors can purchase shares on a platform like Nasdaq Private Market’s SecondMarket®, where the fees are clearly disclosed, and the infrastructure has been built for the transaction to be acknowledged and approved by the company, if they are willing to allow the share transfer.

However, because individual and smaller institutional investors are often blocked from buying private company shares directly, two common workarounds have emerged: Special Purpose Vehicles (SPVs) and, more recently, Tokenized Private Shares. These are access products, meaning they provide smaller investors access to invest indirectly in private shares that typically wouldn’t be permitted by the company.

Let’s break down how these products work—and the risks they carry.

The ABCs of SPVs

Traditional venture capital firms are in the business of raising private funds to invest in a diversified basket of private companies, which they actively manage. These firms act as the General Partner (GP) and sit directly on the company’s cap table. Investors in these funds are called Limited Partners (LPs).

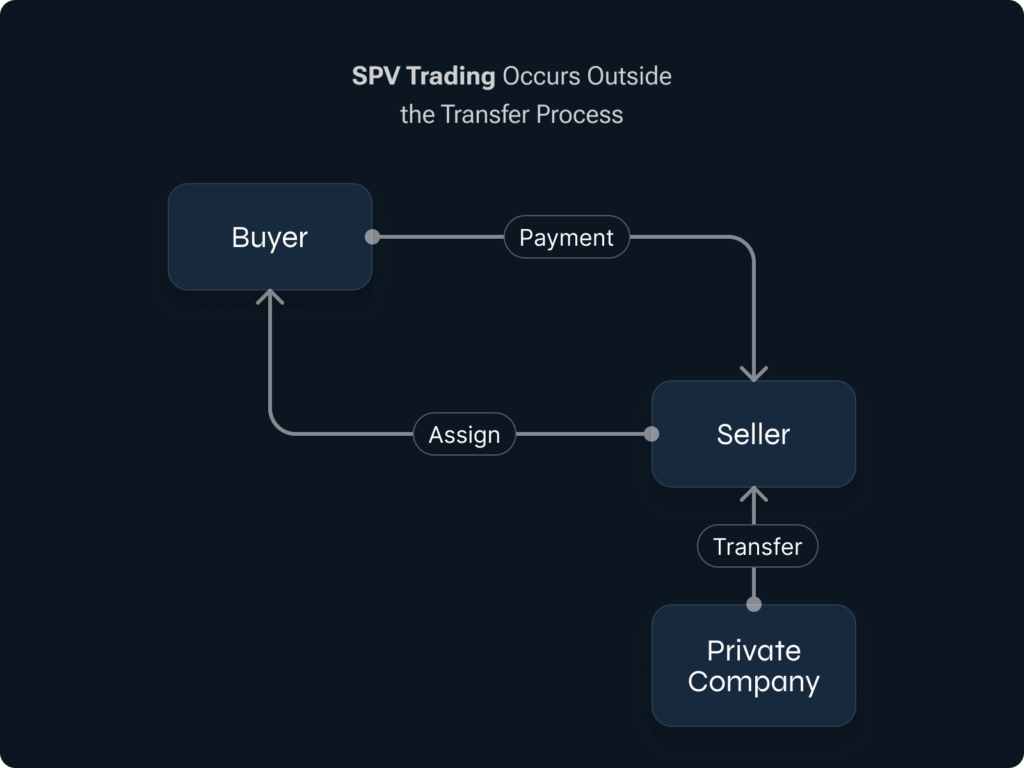

Many SPVs frequently marketed to individual investors work similarly—but with one major difference: instead of a diversified portfolio, they typically hold just one company’s shares. So, if you invest in an SPV of Company X, you’re an LP with ownership interest in a fund that only holds shares of Company X and nothing else.

Source: Nasdaq Private Market

Source: Nasdaq Private Market

It is critical to understand that if you invest in an SPV, you are a Limited Partner in a private fund. You are NOT a direct shareholder in the company.

Today, the vast majority of private shares marketed to individual investors are offered through such single asset SPV structures.

The Rules—and the Red Flags

The SEC imposes regulations on SPVs, including strict rules about who can invest. For instance, investors must be at minimum Accredited Investors or Qualified Purchasers—those who meet specific income, assets, or net worth thresholds—can participate. SPVs also face limits on the total number of investors they can accept.

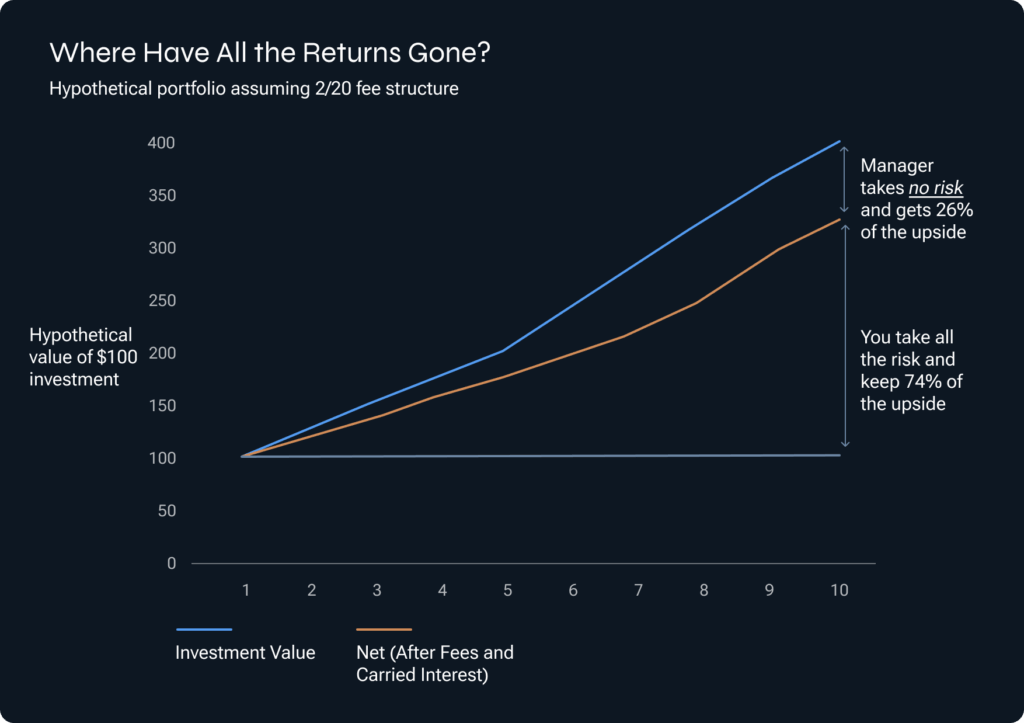

The danger with SPVs often starts with fees. It is important for investors to understand the fees in SPVs are very different than commissions on public stocks. Typically, they are much higher. Some platforms targeting retail investors layer on stiff costs to their SPVs:

- 10% or more upfront commissions or management fees

- 2% annual management fees, or more

- 20% carried interest (i.e., profit share) on any gains, or more

With fee structures like these, unless the underlying investment is a runaway success, much of the investment appreciation, or upside, goes to the GP—not you, the investor. There may be times when high fees could be justified, for example if the fund is giving exposure to a fast-growing, hard-to-access company. As an investor, you need to fully understand the fee structure of any SPV before investing to ensure they are fair.

Source: Nasdaq Private Market

The Risks: Information, Pricing and Liquidity

A major issue with SPVs is access to information—or lack thereof. In the public markets, you know what you are buying because public companies are required to make comprehensive disclosures as to their financial condition to their investors. Private companies have no obligation to make even basic financial disclosures. Regardless, SPV investors are just investors in a fund who indirectly owns the shares. Given the company does not recognize you as an investor, they have no incentive or obligation to share information with you.

Another risk with SPVs is regarding the value of the underlying private shares. Unscrupulous SPV providers can mark up the price of the private shares they are putting into the SPV by excessive amounts, pocketing the difference. If you’re not careful, you could find yourself paying $100 for a $50 stock given the opaque nature of many SPV structures.

Once you buy into an SPV, your expectations for liquidity should be very different than owning a public stock. Liquidity in an SPV is often limited, meaning—you may not be able to resell your investment if needed, even at a significant discount.

If this all sounds like fearmongering, it’s not. On July 8, 2025, The Wall Street Journal reported that an SPV platform with over 750,000 reported users, filed for bankruptcy after the SEC accused it of several abuses described above. In fact, the Journal reported they may have even been misleading investors by selling interests in SPVs where they did not own the underlying private company shares that were being marketed.

Questions to Ask: A Checklist

Importantly, there are numerous reputable platforms offering SPVs with fair, transparent terms, and providing investors with legitimate access to incredible companies. To find them, you need to do your homework—and ask the right questions:

- Are you an accredited investor or qualified purchaser? (You must be, to invest legally.)

- What are the fees—upfront, annual, and performance-based (carried interest)? Are they fair?

- Are there any hidden fees, such as audit, administration, or transfer fees?

- Are the shares in the SPV being marked at fair value, or are they inflated?

- Is the GP reputable? How long have they been in business?

- How many LPs are there in the fund?

- In the private market, a share is not a share. There can be common shares, and multiple series of preferred stock, all with different rights that can result in vastly different financial outcomes in various exit scenarios. What share class is included in the SPV, and what are the unique features of that class that could impact your investment?

- Who is the fund’s administrator, and are they credible? A fund administrator is typically a third party who handles the money movement, investor records, and reporting for the SPV.

- Can the GP prove ownership of the underlying company shares in the SPV?

- Does the SPV sit directly on the company’s cap table? Or is it a “double-layer” SPV—an SPV that owns another SPV? Double layer SPVs compound the fees and significantly dilute your returns.

- Are you comfortable investing in a company where you receive no financial disclosures?

- Can you manage a 10-year hold period or longer on this investment without the need to sell? Does the GP even allow their LPs to sell?

Unfortunately, given the excitement of owning certain high-profile, hot private companies, some investors often fail to ask these important questions. These questions should be considered mandatory diligence items to help avoid the pitfalls that new investors frequently fall victim to in this asset class.

Tokenized Private Shares

Recently, a number of high-profile platforms announced plans to create and offer tokenized private shares in some of the most exciting private companies. There are many reasons investors should be deeply skeptical of these new, untested products. Some of these products appear to be attempts to use crypto jargon to circumvent the legally enforceable transfer restrictions of private companies.

Circumventing a company’s contractual transfer restrictions via tokenization is in a legal and regulatory gray area. Regardless of their regulatory status, these products are in obvious conflict with the interests and legal rights of private companies. In response to the recent announcement of tokenization of its shares, OpenAI put out the following statement last week:

“These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer. Please be careful.”

Another crypto platform recently announced a product where the investor is being asked to buy tokens that do not even own the underlying private shares. Buyers of the token are merely a general creditor to the issuer of the token, and that token issuer has no direct ownership in the underlying private company. The token holders can only hope they get paid back when the time comes, potentially leaving investors with a digital asset that has no underlying claim to the company’s equity.

Given all this uncertainty and risk, investors are justified in being highly skeptical about tokenized private shares.

The Bottom Line

Private markets have never been more exciting. A decade ago, there were fewer than 50 “unicorns”—private companies valued at over $1 billion. Today, there are more than 1,200. As these dynamic companies stay private longer, it’s no surprise that individual investors want in. Eventually, regulation will catch up, bringing to private markets some of the core investor protections we take for granted in the public markets. But until then, investing in private shares remains very much a “buyer beware” endeavor.

We make it our priority at Nasdaq Private Market to provide investors the information, expertise, technology, data, and protections needed to navigate this dynamic but complex asset class with clarity and confidence.

Investors who approach the private markets with diligence and discernment—fully aware of both the risks and the potential rewards—will be best positioned to avoid the traps and capture meaningful long-term value by investing on fair terms in the most exciting companies in the world.