Stay Ahead of the Private Markets

Unparalleled transparency into price factors driving valuations.

Comprehensive data insights powered by Nasdaq Private Market.

Turn on the Power of Premium Access. Free Trial Today.

Diligence companies and monitor pricing using a comprehensive dataset on Tape D®.

Data Built for Today’s Secondary Market Investors

4K+ Companies Tracked

Firmographic data on venture-backed private companies.

175K+ Pages of Filings

Financing data sourced from publicly available company filings.

2K+ Price Histories

Proprietary company share price data generated algorithmically.

1.7M+ Deal Terms

Cap table and fundraising deal terms extracted into structured data.

Request a Free Trial of Tape D Premium Data

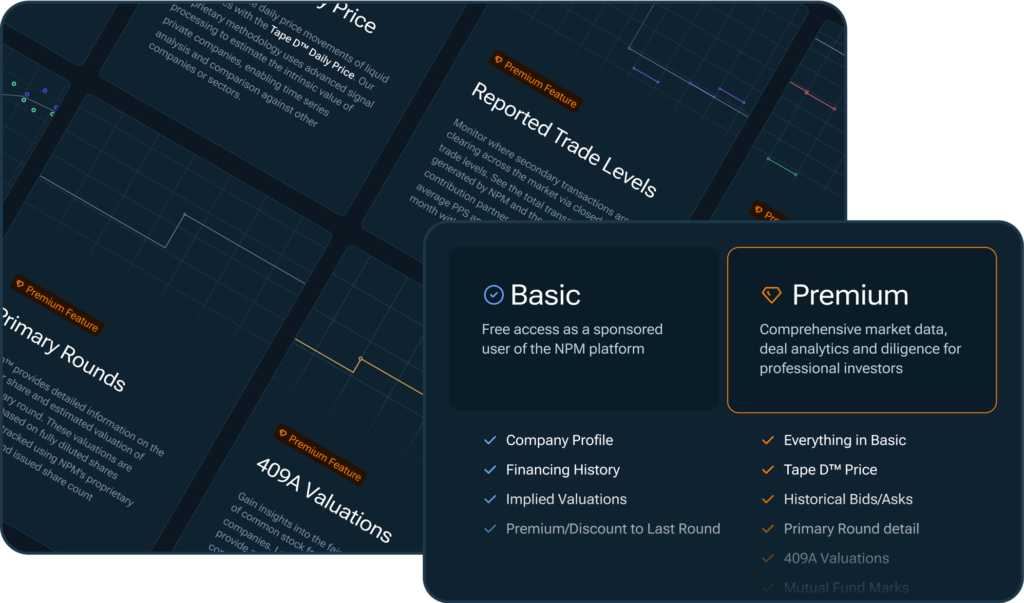

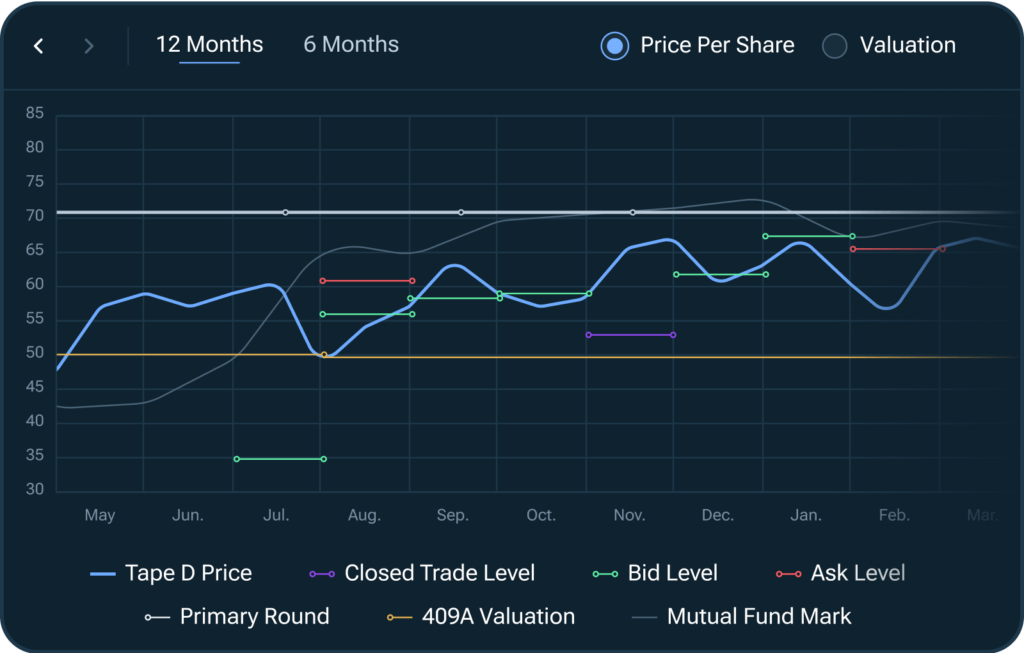

Key Components of Tape D Pricing

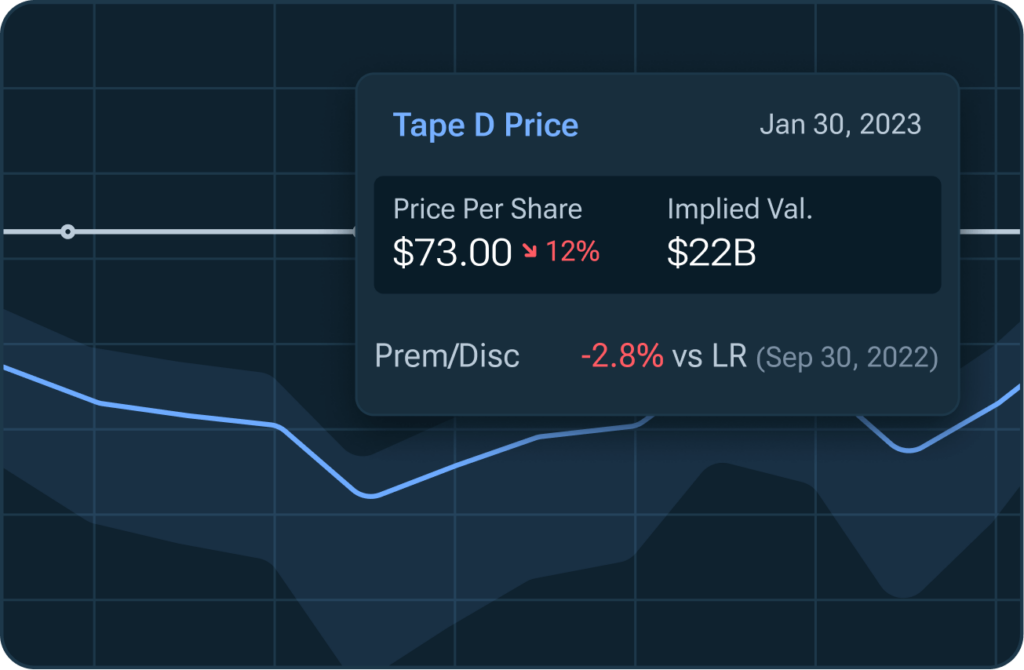

Tape D Daily Price

Access real-time estimated prices and daily price histories for the most actively-traded names.

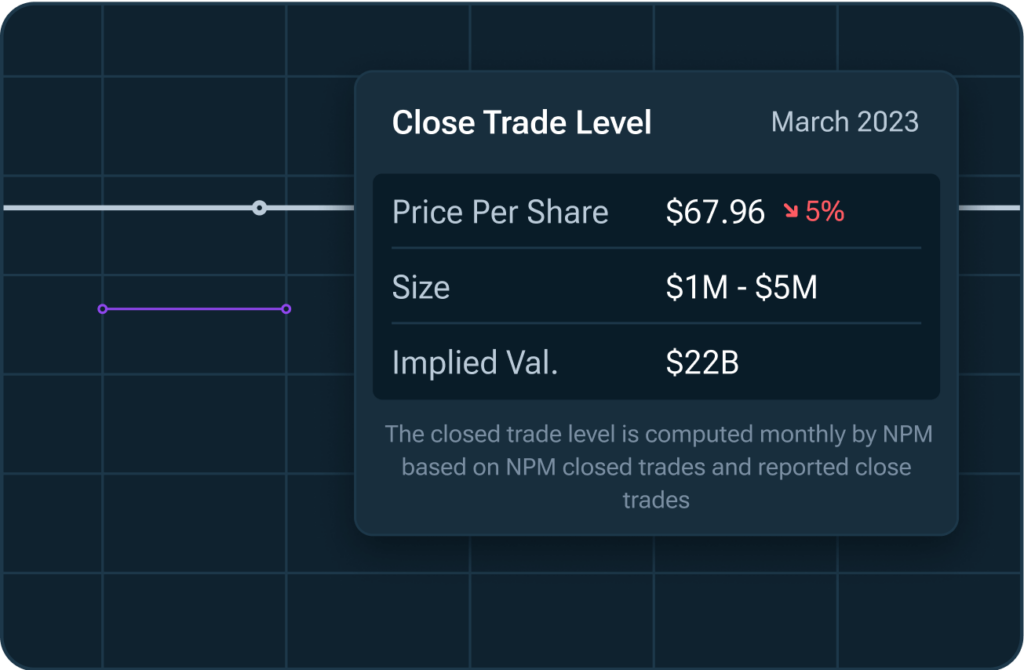

Reported Trade Levels

Source monthly aggregated closed trade data through SecondMarket and NPM’s data contribution network.

Bid + Offer History

Track historical market order indications aggregated across the NPM network of investors and brokers.

Primary Rounds

View detailed round information and estimated valuation using NPM’s proprietary methodology.

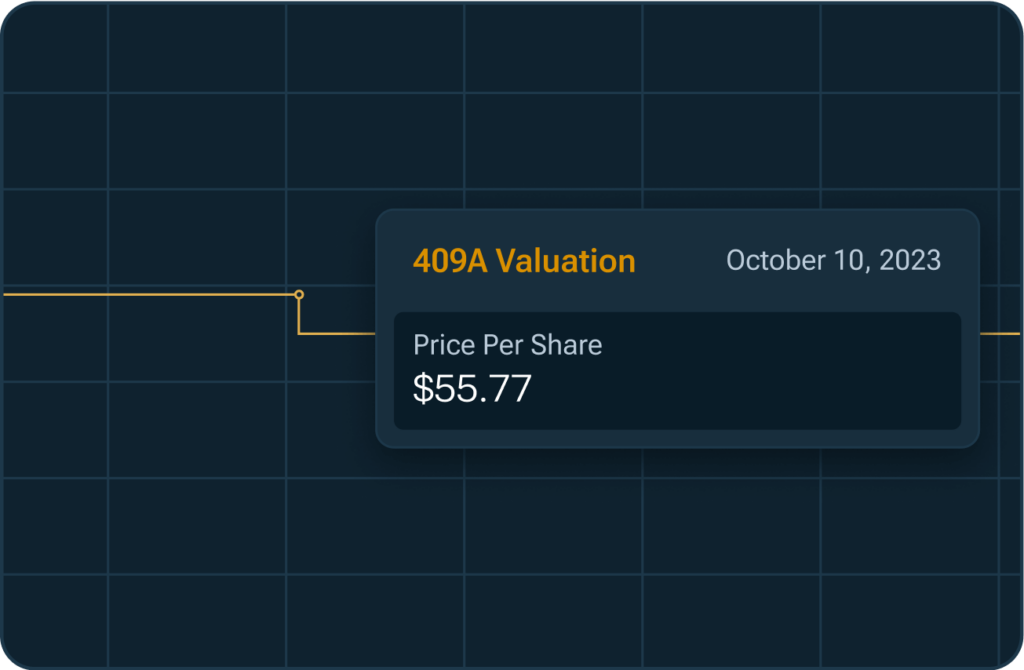

409A Valuations

Gain insights into fair market value of common stock based on accounting disclosures.

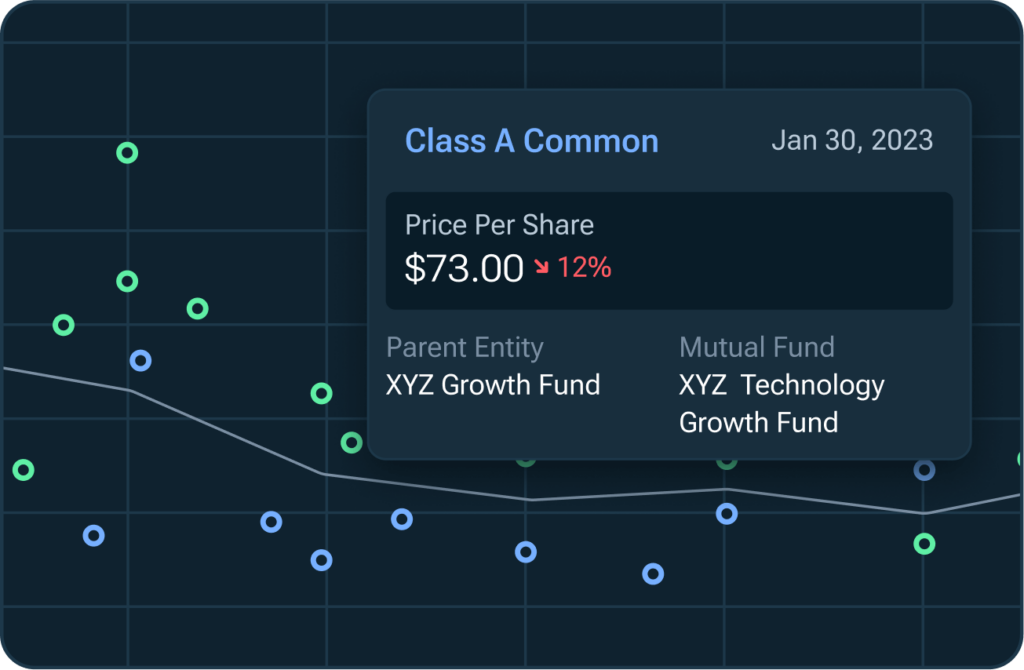

Mutual Fund Marks

Search mutual funds or company names to mark-to-market specific to each share class.

Who Benefits from Tape D?

Request Access eastVenture Capitalists

Leverage daily pricing estimates that provide transparency between primary rounds, ensuring accurate portfolio marks, supported by secondary activity and valuation data.

Asset Managers

Access scenario-based waterfall analysis to evaluate exit outcomes and shareholder distributions using filings data, including share count, liquidation preference and participation rights.

Secondary Investors

View aggregated bid+offer pricing and transaction data to assess how their orders against compare to market activity, helping identify liquidity and opportunities in private assets.

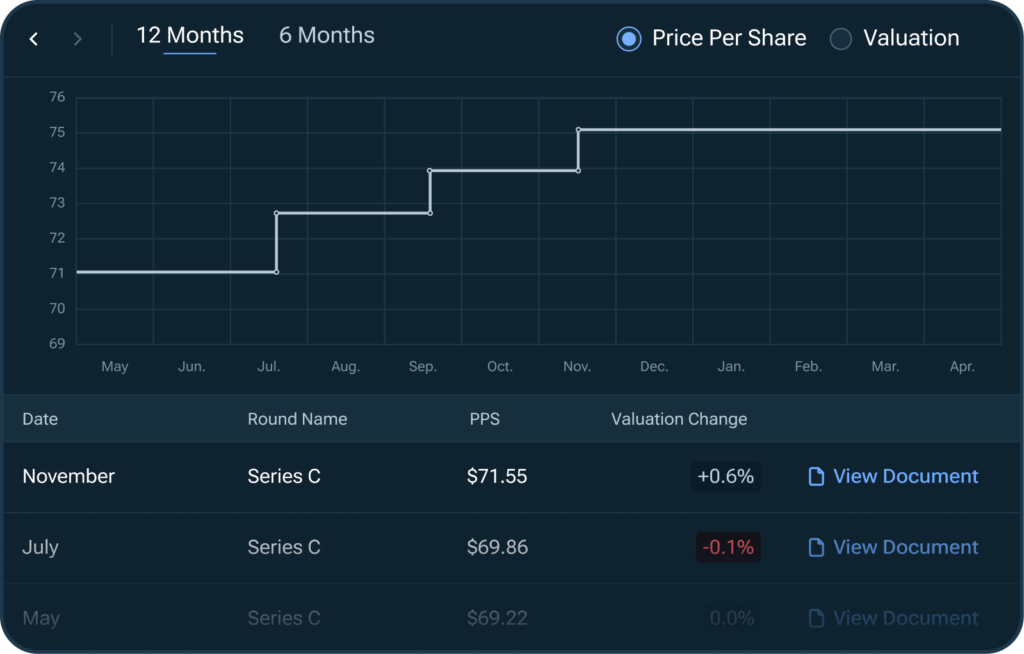

Financing History

Track the financing history of private companies through detailed Form D filings with Edgar. Get key insights into PPS, amounts raised, total capital raised over time, and estimated valuation history, offering a transparent look into a company’s funding journey.

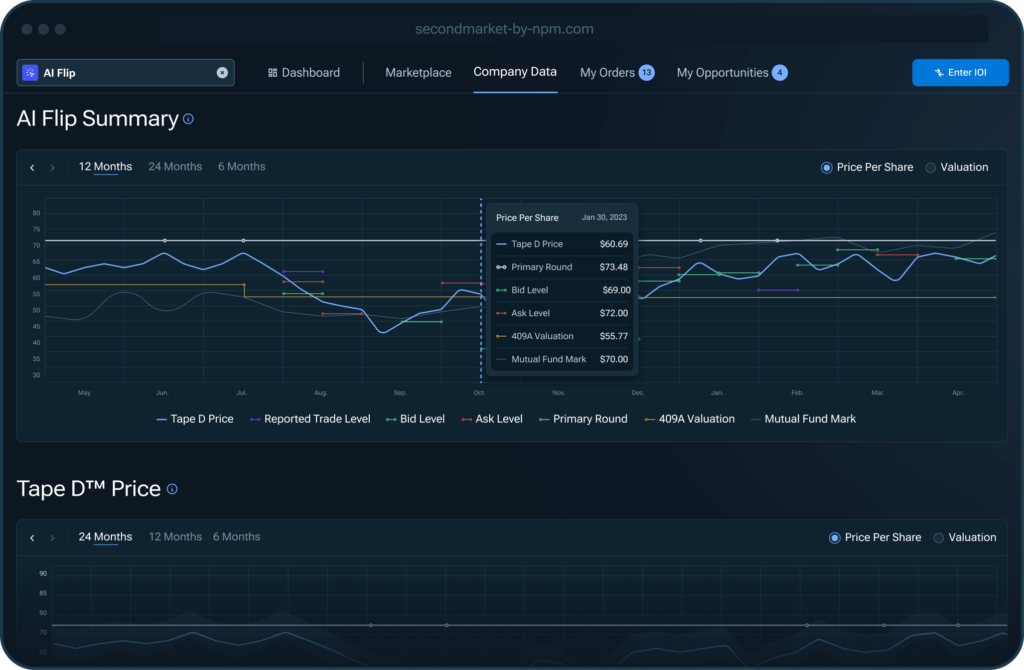

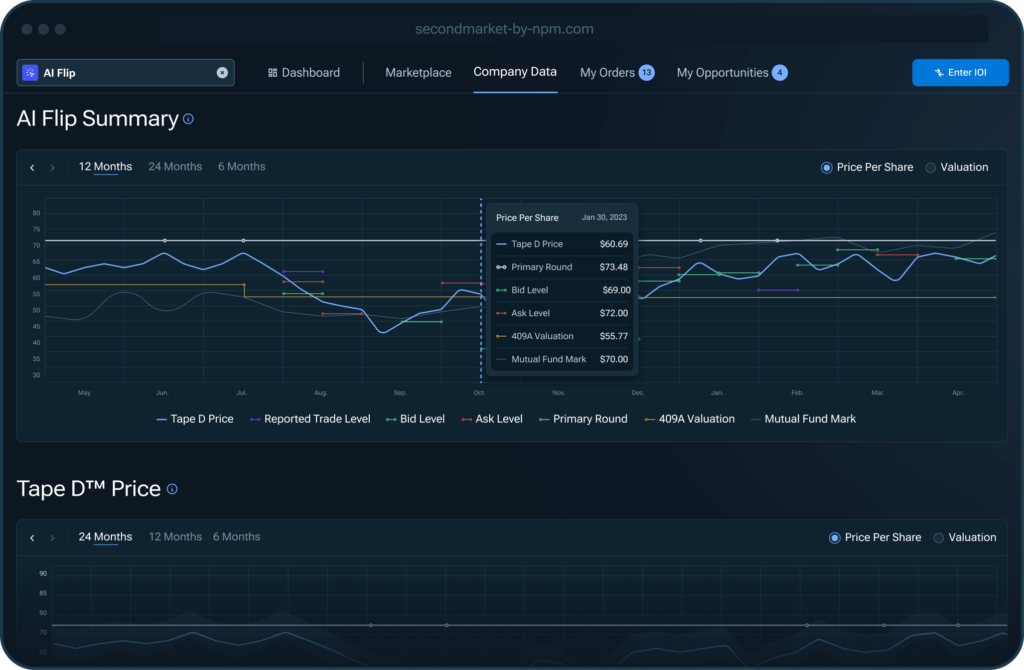

Pricing Data

Gain unmatched visibility into the price history of private companies with data from multiple sources, including NPM’s Tape D® Price, reported closed trades, bid/offer orders, 409a valuations, mutual fund marks, and other important pricing indicators.

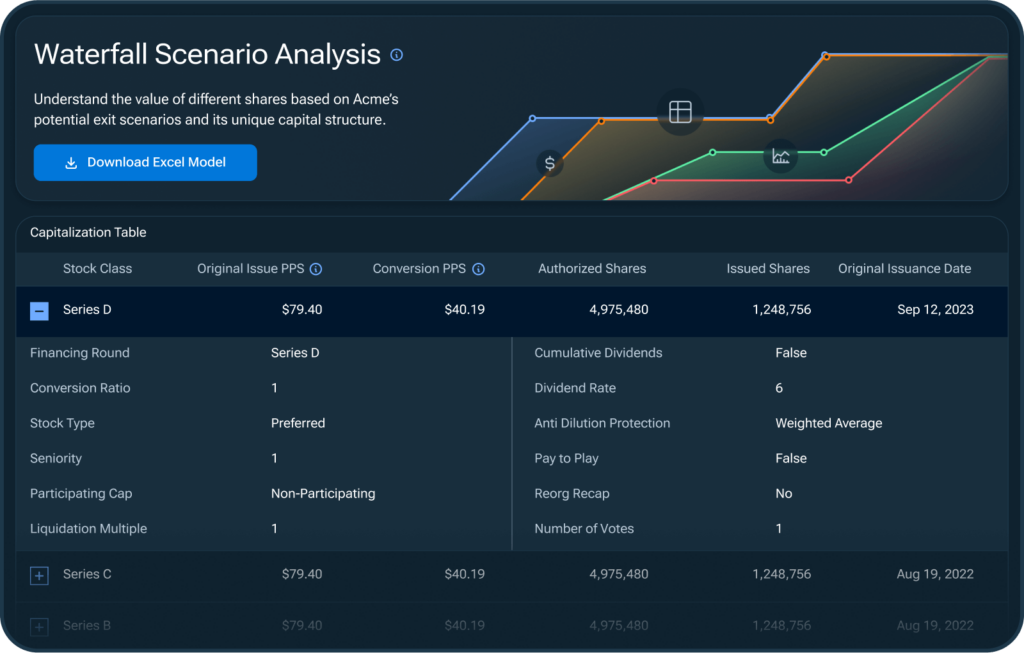

Waterfall Analysis

Evaluate different share classes and their distribution prices per share with our advanced Waterfall Analysis. Explore breakpoints based on various exit values and uncover how each unique capital structure impacts shareholder returns.

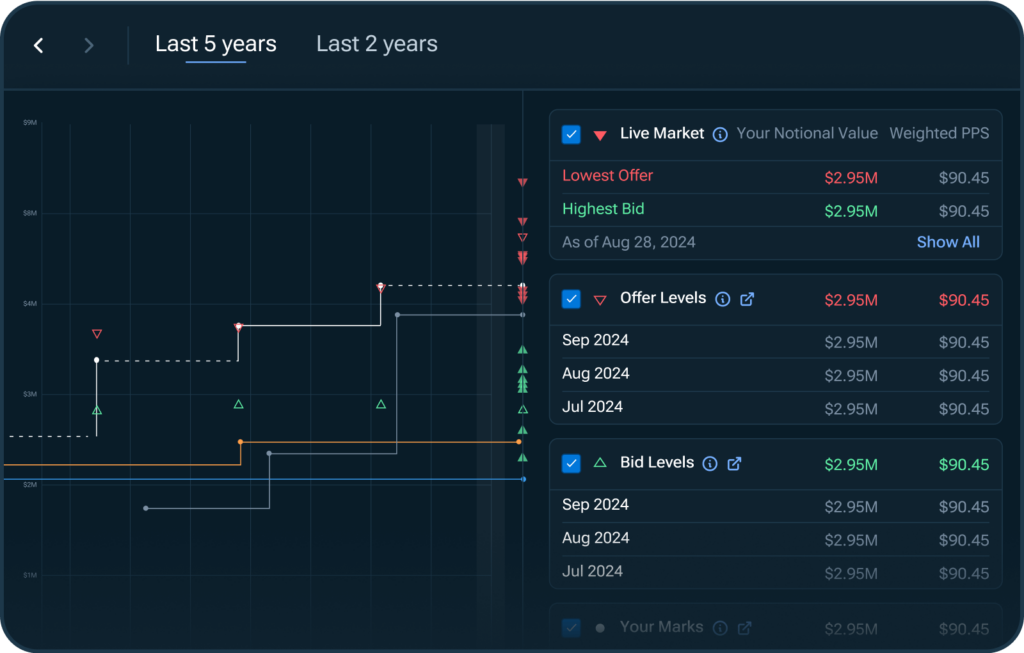

Portfolio Analysis

Analyze your portfolio’s performance over time. Compare your cost basis to current fund marks and see how other investors are valuing their positions to assess your portfolio’s standing.

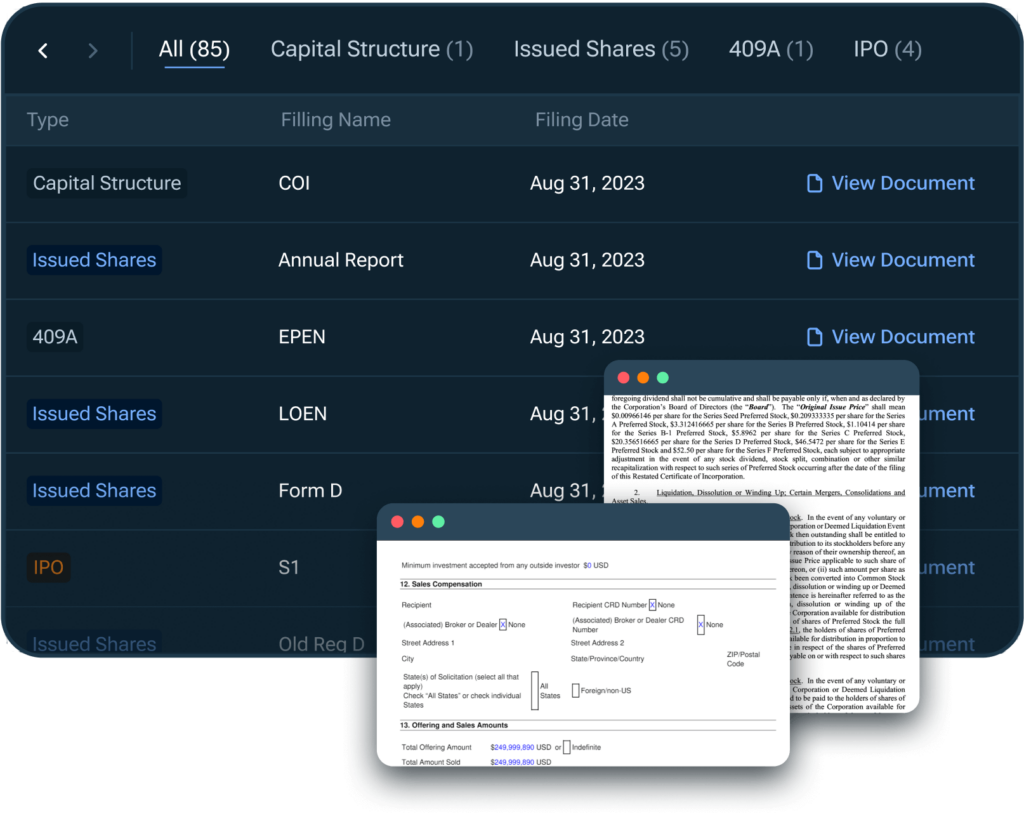

Source Documents

Access a comprehensive library of crucial regulatory filings, including COIs, EPENs, LOENs, annual reports, and more. Leverage hard-to-source documents to make more informed investment decisions.

Your Data Privacy + Protection is Paramount

Your Consent is Required

At NPM, we prioritize your data privacy and protection. We never share your personal information without your explicit consent.

Secure Environment

Data is anonymized and aggregated for privacy, and we employ state-of-the art technology to secure data within our systems.