Investor Trading Tools

Invest intelligently and early in industry-disrupting companies. Tools for VCs, PE, hedge funds, family offices, and other institutional investors.

This Product Helps:

- Investors

Access the Investor Workstation+

- Onboard to our global institutional investor network.

- Access advanced secondary technology, data, and trading.

- Track your secondary portfolio and watchlist activity.

- Fast track trades with patent-pending transfer and settlement workflow.

- A workstation uniquely configured for your private market objectives.

What You Get from the Investor Workstation.

Access to Invite-Only Company Programs ↓

Exclusive invitations to invest in unicorns through company liquidity programs like tender offers and auctions.

Trade Via our SecondMarket® Trading Platform ↓

Actively buy and sell private company shares through broker-sponsored access model or passively through anonymity.

Join a Global Network of Banks, Brokers + Investors ↓

Interact with hundreds of institutional investors and dozens of leading global banks and brokers.

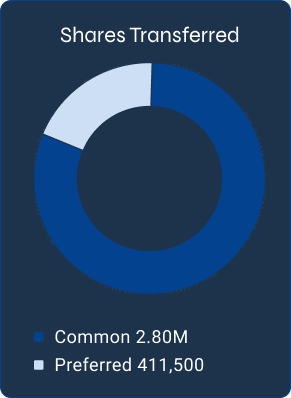

Gain Efficiencies with Settlement Technology ↓

Manage all aspects of share transfer activity from match through settlement using NPM’s proprietary transfer and settlement tools.

Discover Actionable Company Data ↓

Evaluate valuation and firmographic data sourced from company filings and other aggregated third-party resources.

Access Intuitive Tools for Investors

Join the Trading Marketplace

Contact us to get started. Onboard to access the trading marketplace. Explore buying and selling opportunities.

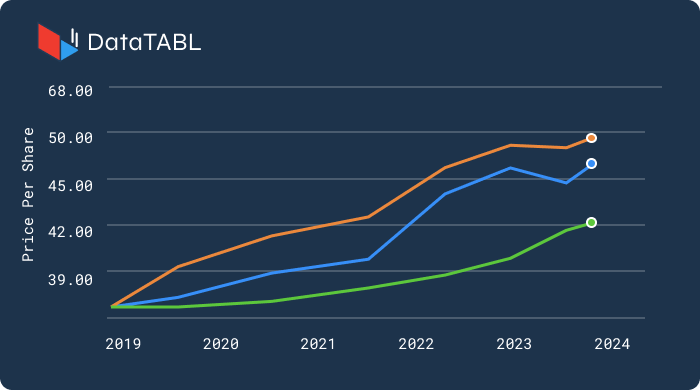

Evaluate Pricing Data + More

Via our comprehensive platform, we can help provide actionable data to help inform your trading decisions.

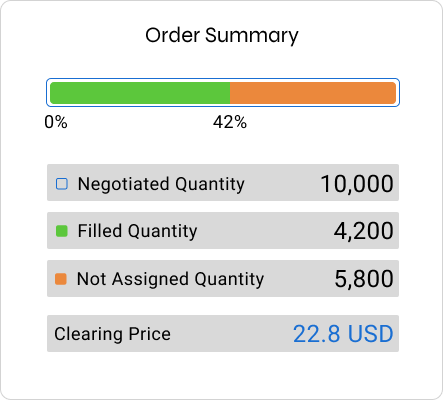

Trade + Monitor Watchlist

Execute trades via sophisticated technology. Manage negotiations and track progress in one platform. Settle seamlessly.

Investment Opportunities.

- Matching institutional investors with company shareholders.

- Identifying investments in Unicorns and other disruptive companies.

- Inviting investors into exclusive trading events and company programs.

- Aligning opportunities to your investment profile, watchlist, and thesis.

Market Color + Intel

Experienced private market product specialists with valuable market intelligence

Trading Infrastructure

Provide critical trading infrastructure for secondary execution, clearance, and settlement

Exclusive Opportunities

Highlight opportunities and help ease challenges in identifying investments and buying stock pre-IPO

Invest in Growth

Venue to buy stock in exciting, industry-disrupting emerging and established private companies with growth potential

Data-Driven

A platform to evaluate an ever-evolving inventory of innovative private company buying opportunities across growth stages, sectors, and countries

Tech-Forward Platform

Institutional-grade marketplace and trading technology to invest in pre-IPO private companies

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of Jan 2025

Access Institutional-Grade Metrics + Analytics

Top Referring Law Firms for Private Company Transactions

-

Goodwin

-

Cooley

-

Latham & Watkins

-

Gunderson Dettmer

-

Simpson Thacher

-

Fenwick & West

-

Wilson Sonsini

-

Kirkland & Ellis

-

Caiola & Rose

-

Paul Hastings

- Company Counsel

- Buyer Counsel

Client Industry Breakdown

Information Technology

49%

Information Technology

49%

Financials

19%

Financials

19%

Health Care

9%

Health Care

9%

Consumer Discretionary

9%

Consumer Discretionary

9%

Industrials

7%

Industrials

7%

Communication Services

4%

Communication Services

4%

Consumer Staples

3%

Consumer Staples

3%

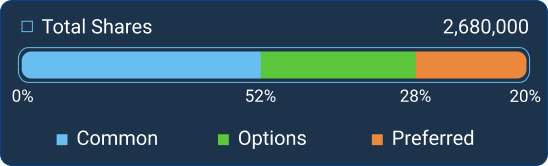

Our Recent Client Valuations

- 15% $0-$250M

- 7% $500M-$1B

- 8% $1B-$2B

- 38% $2B-$5B

- 33% $5B+

Global Client + Investment Network

- 🇦🇺 Australia

- 🇧🇲 Bermuda

- 🇧🇷 Brazil

- 🇨🇦 Canada

- 🇰🇾 Cayman Islands

- 🇨🇴 Colombia

- 🇪🇪 Estonia

- 🇫🇮 Finland

- 🇫🇷 France

- 🇩🇪 Germany

- 🇭🇰 Hong Kong

- 🇮🇩 Indonesia

- 🇮🇱 Israel

- 🇯🇵 Japan

- 🇱🇹 Lithuania

- 🇱🇺 Luxembourg

- 🇲🇽 Mexico

- 🇸🇬 Singapore

- 🇨🇭 Switzerland

- 🇸🇪 Sweden

- 🇺🇦 Ukraine

- 🇬🇧 United Kingdom

- 🇺🇸 United States

Data as of Jan 2025