Part 1 in the Nasdaq Private Market series on private company secondary auctions.

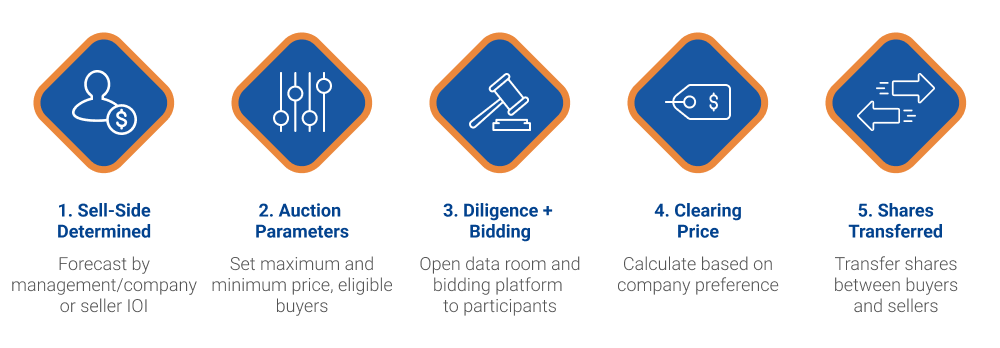

Tender offers are the transaction type that NPM sees most often for private company secondaries. A private tender offer generally follows certain criteria (e.g., 20 or more sellers, open for 20 business days, etc.). According to the SEC, a tender offer is a broad solicitation by a company or a third party to purchase a substantial percentage of a company’s Section 12 registered equity shares or units for a limited period of time. The offer is at a fixed price, usually at a premium over the current market price, and is customarily contingent on shareholders tendering a fixed number of their shares or units (we include company buybacks in this definition since the mechanics are similar)1. There may be more considerations to satisfy all the requirements of a tender offer, and we would highly encourage you to speak with your legal counsel for guidance on participation.

Most private companies and their legal counsel have become comfortable with this transaction type for several reasons, including its predictability and structure. However, as companies stay private longer, they search for alternatives to the tender offer that provide competitive pricing and potentially allow company shareholders to be more involved in the transaction itself.

This brings us to auctions. Auctions have existed in the public markets for decades and have been used in various forms – from Dutch auctions for public offerings to call auctions used by most major stock markets to open and close trading for the day2,3. Interest in auctions within the private markets is on the rise. With dry powder continuing to remain at all-time high levels, growth equity and venture capital investors are looking for more opportunities to deploy their capital. This competitive landscape lends itself perfectly to the auction format.

Nasdaq Private Market has the domain expertise to run several different types of auctions for private company shares. We leverage our legal and operational experience to successfully execute these innovative program structures for our private market clients. There are some risks to holding auctions compared to a standard tender offer or secondary transaction, including but not limited to: large bid-ask spreads leading to few or no matches, inaccurate or lack of floor price, and significant price movement during the end of an auction period.

While there are risks, we believe that auction programs have benefits for the sponsor company, shareholders, and buyers. These benefits include more transparent price discovery, data points for participants, and opportunities for liquidity via standardized windows for trading. Auctions have the ability to change how private companies view liquidity for their employees and shareholders, and may become the dominant form of secondary transactions in the future.

Get started here to learn more.