Law Firms

Partner with an experienced deal team to structure and facilitate secondary transactions for private company clients.

They’ve earned the trust the market has in them – NPM is a world-class platform with superb customer service and a wealth of experience.

Law Firms Benefit from Leveraging Our Comprehensive Solutions

A critical partner to leading law firms globally. Based on the expertise or our seasoned team and innovative solutions, partners and associates select us to refer their most important clients.

Experienced Liquidity Program Team

Ability to manage entire secondary transaction lifecycle and coordination of all relevant stakeholders on behalf of your clients.

Reduce Operational Burden

Outsource client requirements for secondary activity to a industry-leading provider.

Benchmarks + Metrics

Leverage best practices and benchmark data from previous transactions to develop your client’s liquidity program.

Compliant Products

As a regulated broker-dealer that operates an ATS, our compliant framework includes AML/KYC on investors, issuers, and stakeholders.

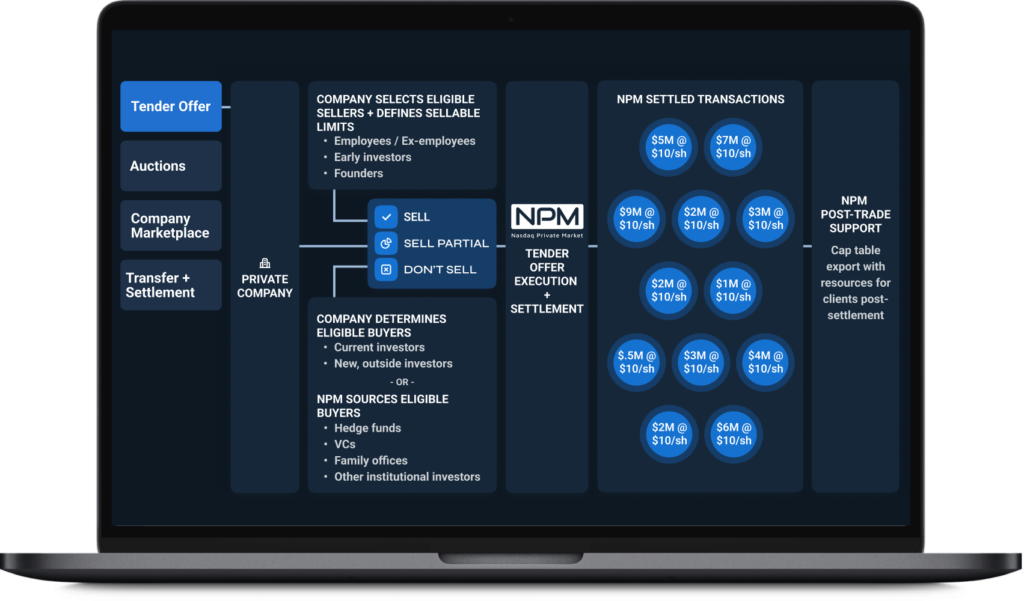

Opportunities for Each Stage of Growth: Multiple Products. One Partner.

Refer A Client eastTools to Help Make Clients' Transactions More Efficient

Cap Table Transfer

- Professional expertise to fast track the transfer of shareholder data.

- Seamlessly import client cap table with shareholder and investor data.

- Audit, verify, and scrub client cap tables ensuring accuracy and transparency.

- Frictionless export of your client’s updated data back into their cap table platform post program.

Settlement Technology

- Share transfer workflow management, and dashboard for companies and attorneys.

- Confirm seller holdings, process ROFR approvals, and provide post-trade reports.

- Tracking of stock transfer agreements, submissions, and overall progress.

- Simplify cash distributions by synchronizing wires and timestamps.

Connect Your Private Market Clients to Institutional Investors via Our Advanced Secondary Platform.

Refer A Client eastCustomizable Workflow + Participant Messaging ↓

Create bespoke program participant messaging and transaction parameters that mirror company objectives.

Integrated + Secure Data Room ↓

Streamline communication for law firms, issuers, and investors via an integrated, real-time data room.

Dynamic Transaction Reporting ↓

View and download all transaction activity from onboarding to execution through settlement via a centralized client and observer dashboard.

Secondary Subject Matter Expertise ↓

Industry-leading secondary guidance, in-depth market intelligence, and professionals paving the path for better client outcomes.

-

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of Jan 2025

Top Referring Law Firms to NPM

- Company Counsel

- Buyer Counsel

-

Goodwin

-

Cooley

-

Latham & Watkins

-

Gunderson Dettmer

-

Simpson Thacher

-

Fenwick & West

-

Wilson Sonsini

-

Kirkland & Ellis

-

Caiola & Rose

-

Paul Hastings

Data Showing From Top 10 Law Firms

Data as of Jan 2025