We've Made Company Liquidity Easy.

Design and launch a company-controlled liquidity program, on your timeline. Easily connect your Pulley cap table to create a successful tender offer with Nasdaq Private Market.

Create a Program east

Our Technology Allows for Full Control + Customization Across Each Step in a Program

Select Structure

Choose to offer liquidity through tenders, trading windows, auctions and more.

Define Mechanics

Leverage our benchmark data and experience to decide rules, restrictions and allocation terms for a program.

Restrict Access

Apply restrictions on preferred eligibility, max sell limits to common and cashless exercise benefits to options.

Approve Sellers

Identify eligible sellers and customize messaging for different participants, from current to previous employees.

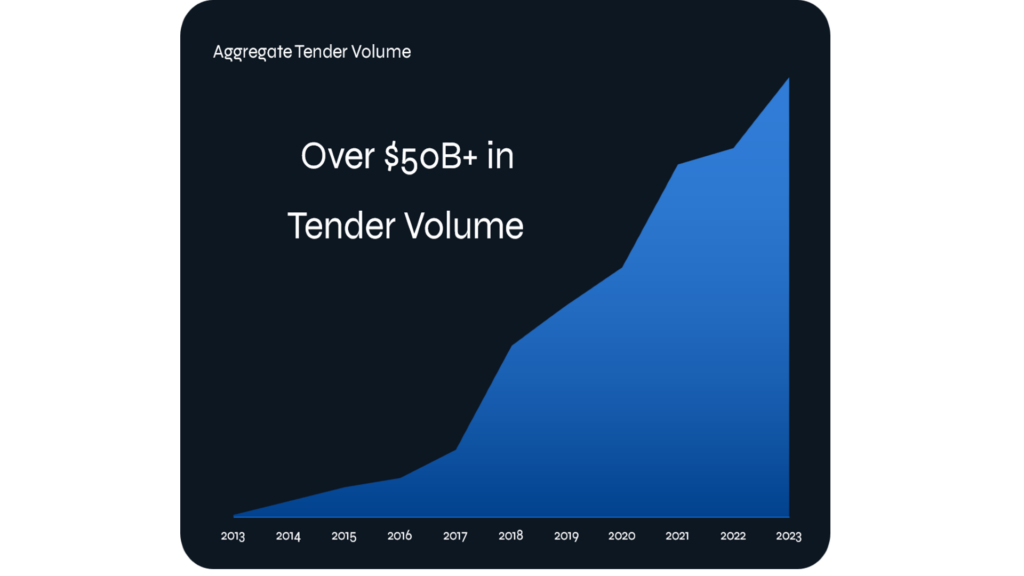

A Leader In Company Tender Programs

Since 2013, we have facilitated 750+ company liquidity programs for Series A to late-stage, pre-IPO companies.

NPM services some of the world’s most innovative private companies with solutions for the liquidity needs of their employees and institutional investors.

Need Tender Program Benchmarking Data?

Tender Offer Benchmarks eastReward + Retain Employees

Convert Employee Equity to Wealth

- An intuitive process for employees to sell their equity.

- Centralized platform to manage documentation.

- Self-service workstation to set share type and quantity.

- Automatic transfer of funds into seller accounts.

- Client success team for questions and assistance.

- Monitoring tools to track tender offer progress.

Build a Strong Company Culture

- Reward an employee-owner mentality.

- Align employee interests with the company’s.

- Incentivize growth by unlocking employee liquidity.

- Enhance company loyalty + reduce turnover.

- Attract top talent with actionable equity plans.

- Compete with public company employee equity.

How to Structure a Liquidity Program

In our conversations with founders, C-suite executives, investors, and advisors, we continue to hear many of the same questions.

When should we offer liquidity? How do we offer liquidity? What should we consider when structuring a program?