Advancing the Private Markets

Connecting the private market ecosystem through technology and data built with and for the industry.

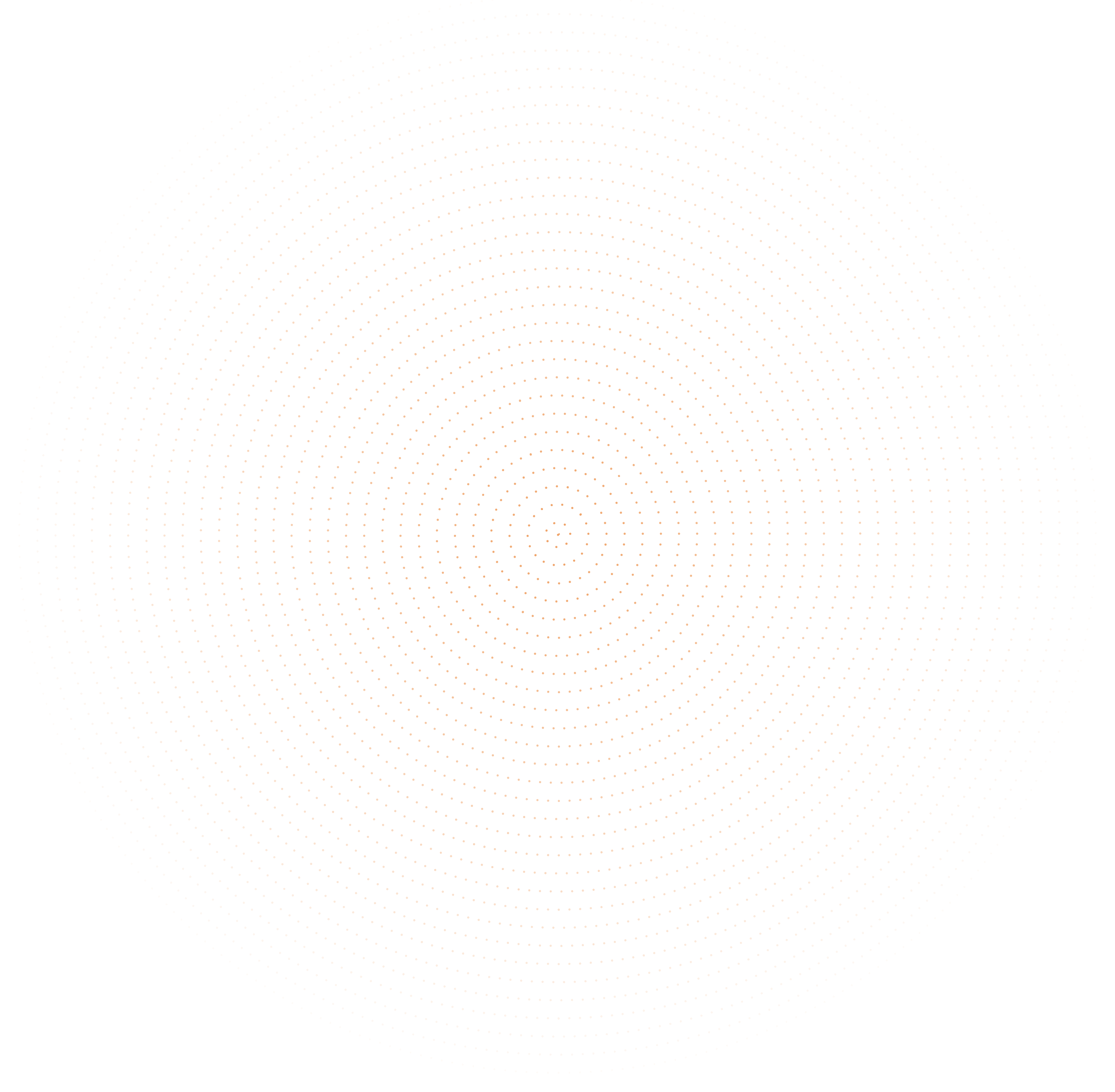

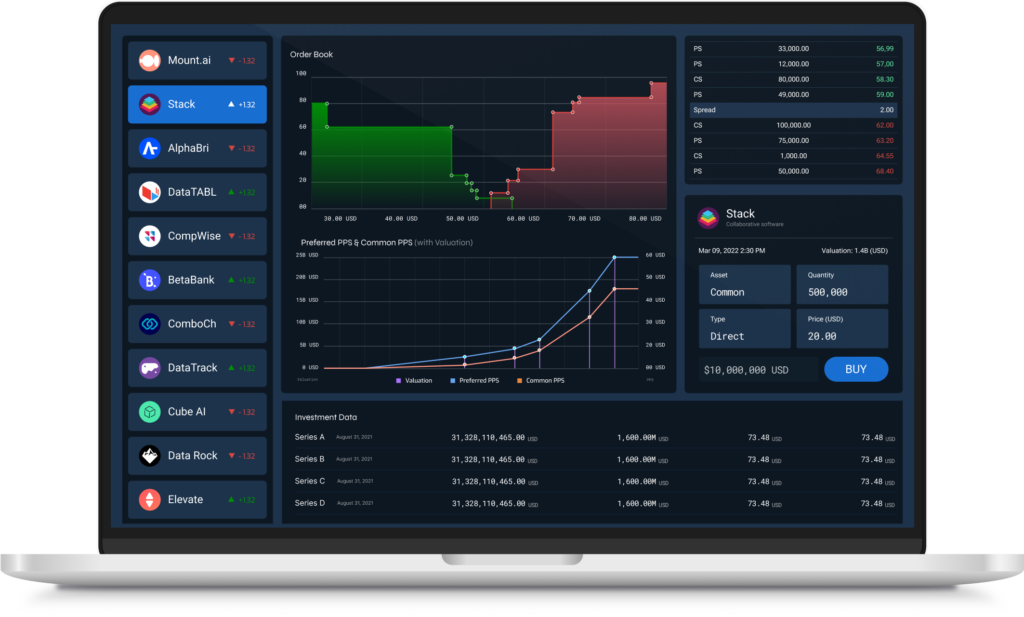

Technology + Marketplace to Trade Private Company Stock

A trusted, institutional-grade secondary trading venue for private companies, banks, brokers, employees, shareholders, and investors. Through insightful product specialists and deep data mining, we provide real-time private market insights for decision-makers. Our expertise, disruptive technology, and actionable data is revolutionizing the experience of buying and selling private company shares.

Unlocking Powerful Private Market Liquidity for People + Companies to Thrive

Building Infrastructure

With start-up agility, deploying institutional integrity technology to make the private market more liquid, investible, and accessible.

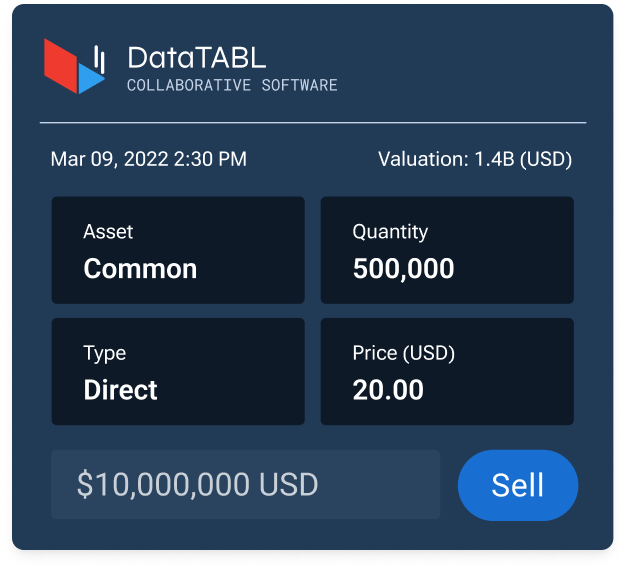

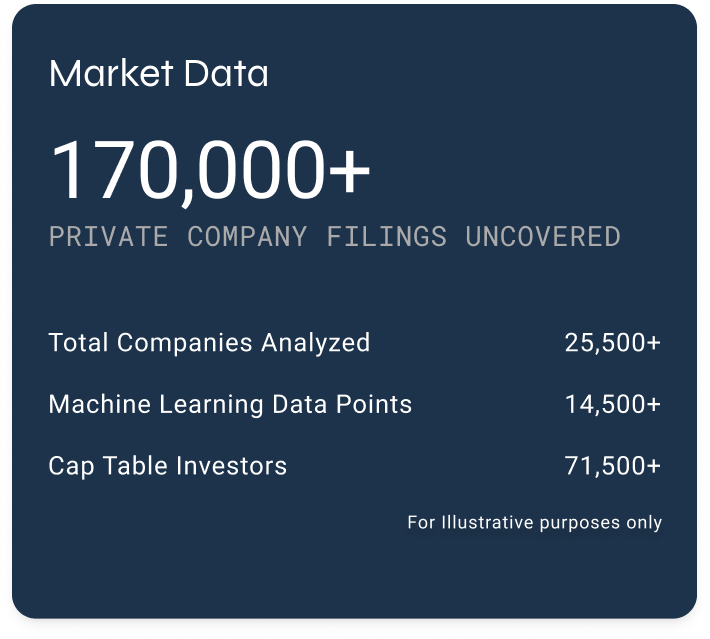

Sourcing Reliable Data

A high-information platform with actionable insights, reliable analytics, and critical market intel.

Establishing Governance

Industry-leading secondary guidance, in-depth market intelligence, and professionals paving the path for better client outcomes.

Longstanding Commitment to the Private Markets

Nasdaq Private Market has been an established, critical provider of technology solutions for the private markets since 2013.

Nasdaq Private Market founded to help solve private company liquidity in direct response to the JOBS Act.

2013

Acquired SecondMarket, a bespoke private market platform and innovator behind secondary transactions.

2015

Spins out from Nasdaq, Inc. with investments from a bank consortium and Nasdaq to build a private company stock marketplace.

2021

Acquired premier private company data products.

2023

Launched private company stock Transfer and Settlement solution.

2023

Nasdaq Private Market Closes $62.4 Million Series B Financing, Led by Nasdaq, with New Investments from BNP Paribas, DRW Venture Capital, UBS, and Wells Fargo.

2024

Guiding Business Principles + Core Values

Serving Our Clients + Community

- Customer Obsessed

- Thought Leaders + Educators

- Commitment to Community

Empowering Excellence + Integrity

- Agile + Collaborative Team

- Leaders with Integrity + Market Expertise

- Tech-Forward + Data-Driven Foundation

Unlock the Private Market Today

Our Institutional-Grade Trading Marketplace for Banks, Brokers, Investors + Shareholders to Buy + Sell Private Company Stock.

Liquidity Programs for Employees to Sell Equity Holdings, Investors Buy Shares + Companies Access Capital.

Capital Flows, Industry Intelligence, Trends, Trade Data, Financings, Valuations + Transaction Datasets.

Unlock the Private Market Today

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of Jan 2025